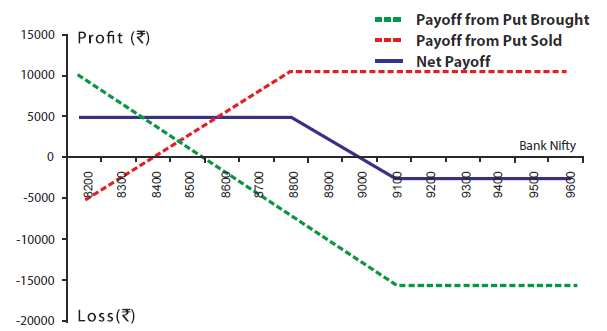

Bear Put Spread Payoff

Néanmoins la méthode la plus couramment utilisée est celle dite de modèle Black-Scholes. Put Option Payoff Diagram.

Bear Put Spread Explained Online Option Trading Guide

It shows a long put.

. Si le sous-jacent est une action dune société cotée procédant au versement dun dividende les émetteurs un groupe bancaire par exemple anticipent. One protective option is purchased. Here we are short a put at 1950 and long a put at 2050.

Bull put spreads collect a credit when entered. 100 orporate bonds payoff. A long put option position is therefore a bearish trade makes money when underlying price goes down and loses when it goes up.

But in fact the security they really own is the put option. This investment strategy provides for minimal risk. Like the case of a single option the instance methods are vectorized so we can compute payoff and profit across a vector or grid.

The stock market contracted so much that it would take until 1954 to fully regain its pre-crash value. 55 of 100 notional T 0 Portfolio A. You can quickly see in the last column that the AAPL credit put spread would return a handsome 471 in 2 weeks if the stock price remains flat or moves higher by expiration.

The butterfly spread is a neutral strategy that is a combination of a bull spread and a bear spread. A bear call spread is an option strategy that involves the sale of a call option and simultaneous purchase of a call option on the same underlying asset. For example a bull spread constructed from calls eg long a 50 call short a 60 call combined with a bear spread constructed from puts eg long a 60 put short a 50 put has a constant payoff of the.

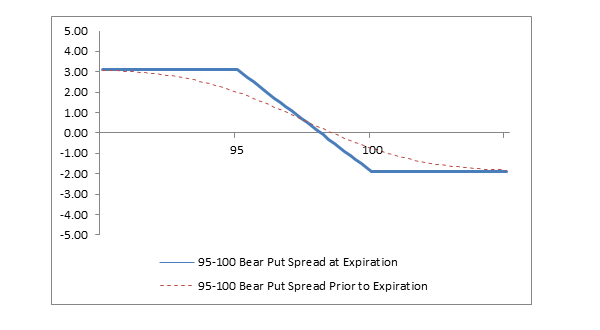

The bull put credit spread payoff diagram clearly outlines the defined risk and reward of credit spreads. The first bearish strategy we will look into is the Bear Put Spread which as you may have guessed is the equivalent of the Bull Call Spread. It is a limited profit limited risk options strategy.

If you are a bit lost in the longshortbullishbearish terminology see Call Put Long Short Bull Bear. As you can observe the payoff is similar to a bear put spread where both the profits under best case scenario and losses under worst case scenario is pre defined. Similar to the Bear Put Spread the Bear Call Spread is a two leg option strategy invoked when the view on the market is moderately bearish.

Butterfly Spread Payoff Diagram. A dual option position involving a bull and bear spread with identical expiry dates. If the stock price has decreased an opposing bear call credit spread can be opened above the put spread to create an.

With no relief in sight as local officials have showed no empathy there is talk of alleged payoff to host the Manila Water Cardona plant. T 0 Portfolio B. Lets examine this credit put spread piece by piece.

83 Strategy Generalization. If the stock price has moved down a bear put debit spread could be added at the same strike price and expiration as the bull call. La valorisation dun put avant la date de maturité nest pas chose aisée puisquil faut estimer la valeur du sous-jacent dans le futur.

000 Commissions Option Trading. The row that is outlined in red is showing a credit put spread in AAPL with 2 weeks to go at the time of the snapshot. Definition of bear with us in the Idioms Dictionary.

The credit received is the maximum potential profit for the trade. Bear with us phrase. Bull call spreads require a debit when entered.

The stock market crash of 1929 put an end to the Roaring 20s and started the Great Depression. Assume a recovery rate of 45 Risk free bonds payoff. Put up with make allowance for.

From pyfinance import options as op. Risk free bonds payoff. The debit paid is the maximum potential loss for the trade.

A protective option or married option is a financial transaction in which the holder of securities buys a type of financial options contract known as a call or a put against stock that they own or are shortingThe buyer of a protective option pays compensation or premium for this transaction which can limit losses on their stock position. You can see the payoff graph below. 100 No payment made on CDS T 1 Credit event.

In options trading a box spread is a combination of positions that has a certain ie riskless payoff considered to be simply delta neutral interest rate position. CDS spread corporate bond spread T 1 No Default. For them to make a profit the put option must increase in price so they can sell it for a higher price than for which they have bought it.

When you buy and own a put option you have a long put position. Please do bear in mind the payoff is upon expiry which means to say that the trader is expected to hold these positions till expiry. They are long the put option.

Here is an example of constructing a bear spread which is a combination of 2 puts or 2 calls put is the default. The bull call spread payoff diagram clearly outlines the defined risk and reward of debit spreads. 45 Payment on CDS.

100 orporate bonds payoff. What does bear with us expression mean. Scenario 1 Market expires at 7800 above long put option ie 7600.

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-04-d02438bef9d24de79e98dd8d29b157f8.png)

No comments for "Bear Put Spread Payoff"

Post a Comment